Trading efficiently in financial markets often requires a deep understanding of price action and technical analysis. Harmonic patterns, unique graphical formations derived from Fibonacci ratios, have emerged as a valuable tool for traders seeking to predict potential trend reversals or continuations. By recognizing these patterns, traders can gain

Examining SSO ETF Success: Thriving in an Upward Trend

As investors eagerly anticipate the market's trajectory, understanding the performance of key ETFs like SSO becomes paramount. This in-depth analysis delves into the current performance of the SSO ETF, focusing on its remarkable returns within the context of the ongoing bull market. The strong economic climate has fueled growth across various secto

Evaluating RSPF's Financial Sector Exposure

The capital sector is a complex and often volatile landscape. Investors seeking exposure to this space may consider ETFs like the RSPF, which provides targeted sector allocation of financial companies. Analyzing the RSPF ETF's performance requires a nuanced strategy that considers both its underlying holdings. Factors such as interest rates, regu

Dominate Canadian Markets with Algorithmic Trading

Unleash the strength of algorithmic trading to thrive in the dynamic Canadian market. With our cutting-edge strategies, you can enhance your trading operations, leveraging profitable patterns with speed. Our robust algorithms interpret vast amounts of market data, delivering actionable insights that can boost your returns. Integrate the future of t

Unlock Canadian Markets with Algorithmic Trading

The volatile Canadian market presents a lucrative landscape for traders seeking to amplify their returns. By utilizing the power of algorithmic trading, you can gain a competitive edge and dominate this complex environment. Algorithmic trading automates your trading tactics, executing trades with precision that surpasses human capabilities. With ad

Daniel Stern Then & Now!

Daniel Stern Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Pauley Perrette Then & Now!

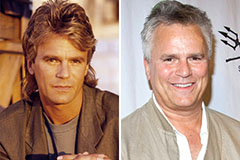

Pauley Perrette Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!